Executive Summary

- A class action lawsuit alleges that many of the world’s largest banks conspired to drive down the price of gold.

- Everyone who sold gold between January 1, 2004 and June 30, 2013 may be part of the class and entitled to a pay out or may lose their rights to sue.

- Information on how to file a claim or take other actions with respect to the lawsuit is below.

- Pease & Curren is not part of the lawsuit or conspiracy and is providing this information to assist the industries we serve.

Was the gold market rigged by some of the world’s largest banks? Gold refineries and others who sell gold have recently been receiving notices that they may be eligible for payment under a class action lawsuit being litigated in the Federal Southern District of New York. As stated in In re Commodity Exchange Inc., Gold Futures and Options Trading Litigation, Civil Action No.: 14-MD-2548-VEC, class action lawyers are claiming that a group of financial institutions conspired to drive down the gold price.

Pease & Curren is not part of the case and is providing this information to assist the industries we serve.

Two of the Defendant banks, Deutsche Bank and HSBC, have agreed to settle and are creating a $102 million dollar settlement fund to pay those harmed by the price of gold being driven down. Litigation continues against a number of other banks that were allegedly part of the conspiracy but have refused to settle.

The class action lawsuit is being litigated in the U.S. District Court in Manhattan.

THE ALLEGED CONSPIRACY INVOLVES MANIPULATING THE LONDON FIX BETWEEN JANUARY 1, 2004 AND JUNE 30, 2013 TO DRIVE DOWN THE PRICE OF GOLD

The London Fix is a benchmark for the price of gold that is set twice daily. It results from a telephone call between five banks that conduct an auction for gold bars. The price that they arrive at is published, and many contractual agreements in the gold market use the published price.

A Pease & Curren gold bar. Did this bar sell for less because of some bankers’ conspiracy?

Although the phone call was ostensibly a neutral auction to arrive at the gold price where supply met demand, the lawsuit claims that the banks used the call to their own advantage. The banks traded gold on behalf of their clients, but they also traded their own gold. The lawsuit claims that banks submitted false transactions that were never executed to drive the price down. It also claims that the banks traded during the fix phone call using their advance notice of what was happening, before the results of the telephonic auction would be made public.

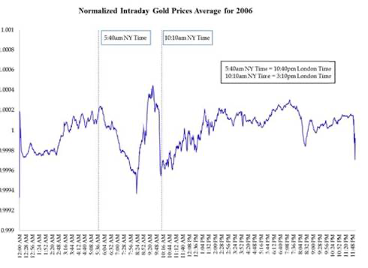

This is an example from the lawsuit of how the price of gold would plummet during the Second London Fix.

The lawsuit did not have damning emails or recorded phone calls describing the conspiracy. Instead, it relied on statistical analyses conducted by economists showing suspicious trading behaviors surrounding the auction. Many of the graphs noted that the price of gold would plummet around the afternoon London fix (which occurred in the morning for New York).

This chart from the lawsuit synthesizes the average movement in the gold price at different times of day during the year 2006, showing a steep drop around the time of the afternoon London Fix.

The lawsuit noted that once the telephone auction came under the scrutiny of government regulators, the abnormal price dip during the second London fix mysteriously disappeared.

For their part, the defendant banks argued that the correlation between the downward trend in the gold price and time of day might have resulted from repetitive behaviors of large market participants, like gold refineries, who it argued sold gold at the same time day after day. The judge allowed the lawsuit to proceed, causing two of the banks to settle.

THIS CLASS ACTION LAWSUIT COULD AFFECT YOUR RIGHTS EVEN IF YOU DO NOTHING

This case is an “opt-out” class action. This means that if you are part of the class, and do not affirmatively withdraw from the case, you are technically considered to be in it. And if you are in it, and you do not fill out a claim form, you lose your right to sue the defendants for the alleged conspiracy.

Simplifying the complex legal language, the class is defined as anyone (person, company, non-profit, etc.) who sold gold or a financial asset based on the price of gold between January 1, 2004 and June 30, 2013 (the full legal definition of the class available at goldfixsettlement.com).

It does not appear that you need to have sold the gold at the London Fix price to be a part of the class.

REFINING GOLD DURING THE TIME PERIOD PROBABLY MAKES YOU A CLASS MEMBER

Although this blog cannot be relied upon for legal advice, refining gold with Pease & Curren or elsewhere during the affected time period probably makes you a part of the class. Typically, in a refining transaction, you pay a fee for the refining service and then ownership of your metal passes to the refiner in exchange for the refiner’s payment to you. Also, if you sold out of an account on hold with a gold refinery like Pease & Curren during this time period, you likely would be part of the class.

Was he melting your gold? You might be part of the class.

WHAT YOU CAN DO IF YOU ARE A CLASS MEMBER?

If you do nothing, you lose the right to sue for this alleged conspiracy and do not receive any payment. A second option is to exclude yourself from the settlement by making a signed written request received no later than August 6, 2021 (instructions here are a bit complex). This would allow you to sue separately – a difficult and expensive prospect.

Another option is to fill out a claim form (available at www.goldfixsettlement.com) to go after your portion of the $102 million pot of money. The class action lawyers are seeking $28.2 million and $11 million of expenses out of the same pot for their fees. It is unclear that a claim would bring the average gold refining customer much money, but depending on the volume of gold sold it may be worth one’s time. The last option would be to object to the settlement to seek either a higher payout from the settling banks and/or lower payments for the lawyers. This would involve hiring a lawyer to appear in the NYC court house, and is probably beyond the scope of most refining customers. It may be a viable strategy for larger industry groups such as the National Pawn Association or Jewelers Board of Trade. Conventional wisdom in the legal profession is that the lawyers are usually the only “winners” in a class action settlement.

THIS GOLD REFINER’S TAKEAWAY

The price of precious metals like gold usually involves more factors than meet the eye. Businesses that buy scrap gold regularly but lack a regular refining schedule risk unwittingly taking on a huge speculative position on the price of gold. With banks settling, we will probably never know the truth about this alleged conspiracy. But one thing is for sure – the unconnected hoarder who bets their fortune on the price of gold is taking a major financial risk!

About the Author:

Before joining Pease & Curren, Frank Curren graduated from Georgetown Law and worked for a Boston based non-profit, focusing on litigation between debtors, creditors, and debt collectors.

Frank Curren, Vice President