EXECUTIVE SUMMARY

- Pease & Curren has no involvement in the Republic Metals Corporation bankruptcy, but is providing ongoing commentary as a service to the industries we work with.

- Although Pease & Curren is uninvolved, numerous other precious metal refineries (or companies that call themselves “refineries”) have been sued as part of the bankruptcy of gold and silver refiner Republic Metals Corporation (A list of companies sued appears below.)

- The trustee is attempting to “claw-back” funds (in some cases, millions of dollars) alleged to have been received by the refineries from Republic Metals after it had become insolvent.

- If the refineries being sued go bankrupt themselves, their customers could also be subject to “claw-backs” and other losses.

Pease & Curren’s Precious Metals Refinery in Warwick, RI. Pease & Curren has no involvement in the Republic bankruptcy

INDUSTRY IN CHAOS AS TRUSTEE SEEKS CLAWBACKS FROM GEIB, MID-STATES, NOBLE, AND OTHERS

When Miami gold and silver refinery, Republic Metals, went bankrupt, many onlookers were surprised to see how many businesses that call themselves precious metal refiners were owed money. Pease & Curren refines precious metals to pure and did not do business with Republic Metals. It is believed that the businesses that sent materials to Republic Metals were unable to refine the material themselves. We are providing this information as a resource to the industries we serve. Review our prior FAQs on the case here.

The Republic Bankruptcy and Claw Back Litigation is being fought in the Southern District of New York.

As Republic’s bankruptcy case has progressed, many of the so-called precious metal refineries that did business with Republic have themselves been sued, and in large amounts. The chart below represents the amounts that these companies have been sued for.

These Companies Have Been Sued As Part Of The Republic Bankruptcy

| Company Name | Clawback Amount (USD) |

| Geib Refining Corp. | $8,181,244.98 |

| Mid-States Recycling, Inc. | $4,757,878.44 |

| Instant Gold Refining, Inc. | $3,173,494.72 |

| QML, Inc. | $2,776,575.43 |

| Ross Metals Corporation | $1,907,521.40 |

| Gannon & Scott, Inc. | $1,366,313.43 |

| Noble Metal Services, Inc. | $948,958.35 |

| General Refining and Smelting Corp. | $515,480.88 |

| Sandy Smith Refining, LLC | $500,141.54 |

| Low Grade Specialists, LLC | $394,072.88 |

| Jack Hunt Coin Broker, Inc. | $179,133.58 |

When a company—such as Republic—files for bankruptcy, funds that it paid out to others while it was insolvent (unable to meet all of its obligations) may be “clawed-back” by the bankruptcy trustee to spread the losses from the bankruptcy more equitably amongst the bankrupt firm’s creditors (Check out Pease & Curren’s prior coverage of the claw-back potential engendered by Republic’s bankruptcy here). The trustee appears to have set her sights on other refineries that withdrew money from pool accounts with Republic prior to the Bankruptcy, or received other payments. She has alleged that the companies above received the above payments after Republic was insolvent and is seeking to have them returned to be paid out more generally among all creditors.

WILL THE REPUBLIC BANKRUPTCY CAUSE OTHER SO-CALLED REFINERIES TO GO BANKRUPT THEMSELVES?

The short answer is that we don’t know. This is why it is may be desirable to ship to a company, like Pease & Curren, that has no exposure to the Republic bankruptcy. With amounts as large as what Geib (sued for over $8 million) and Mid-States (sued for over $4.5 million) have at risk, one wonders. The companies are defending the lawsuits and may be able to limit their losses. Then again, the trustee presumably would not have brought the suits if she did not believe that she would be able to recover enough funds to make the effort worth her while. As the litigation proceeds in the courts, more may come out about how Republic became insolvent, and what the so-called refiners knew when they withdrew their funds. Pease & Curren has no inside knowledge of any other precious metal refinery’s finances and cannot make a definitive prediction.

INTENSE BICKERING ON SOCIAL MEDIA SUGGESTS THAT THE SUED REFINERIES ARE FEELING THE HEAT

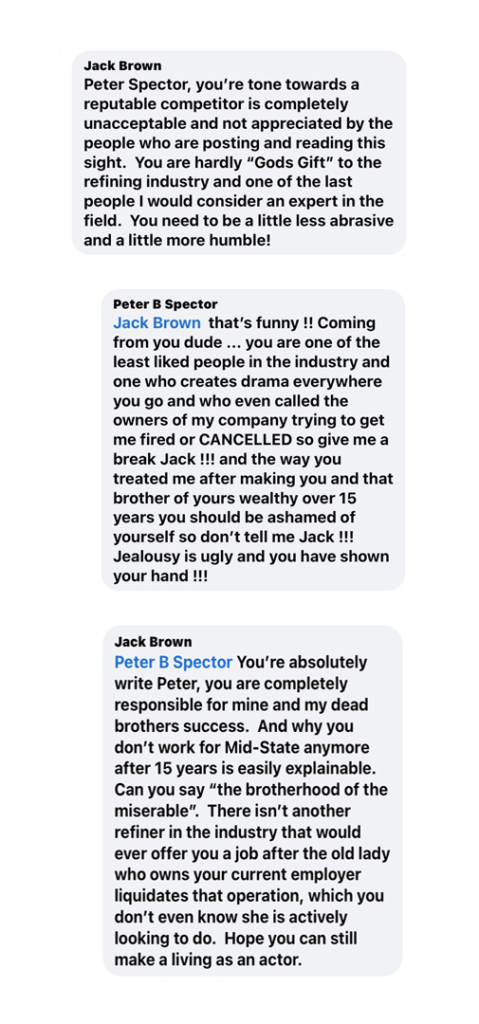

In the wake of the clawback litigation some of the refiners on the list with the most to lose have been stirring up social media with unusually ferocious arguments. For example, Jack Brown of Midstates (sued for over $4.5 million) castigated Peter Spector of Geib (sued for over $8 million) for Spector’s “tone towards a reputable competitor.” Brown also claimed that Geib’s owners are looking to “liquidate” the company. See a fuller version of the exchange below, drawn from publicly available social media postings.

Above: Social Media Bickering Between Personnel of Geib Refinging Corp. and Midstates Recyling Alludes to the Prospect of Further Corporate Liquidations.

This level of discourse certainly does not instill confidence in either firm’s management culture. Whether this nasty conversation comes out of financial anxiety as each of these precious metal refiners faces millions of dollars of liability, or just general acrimony, remains to be seen.

WHAT COULD HAPPEN TO ME IF MY “REFINER” GOES BANKRUPT?

With big money lawsuits and rumors of “liquidation” on social media, many are wondering what would happen if they ship precious metals to a company that later goes out of business. This is an important reason to only refine with financially stable companies like Pease & Curren. The short answer is that those who do business with a bankrupt precious metals refinery (or so-called “precious metals refinery”) may themselves be subjected to losses and claw-back lawsuits. The level of risk would probably depend on a number of factors, including:

- Will the refiner file for bankruptcy while in possession of your scrap?

- Have you ever stored metals on a pool, hold, or consignment account with the refiner?

- Will you receive a payment from the refiner within 90 days of the bankruptcy, or after the time when a court later determines the refiner was “insolvent” (unable to meet all of its financial obligations).

Insolvency periods can be long, as troubled firms can often juggle payments and hold off creditors even though they are not really financially stable. A court might also find that a company on this list was made insolvent because of the Republic bankruptcy. This means that if you ship to a refiner on this list, and it later goes bankrupt, you may be subject to claw-back litigation just like these companies have been.

WOULD THE TRUSTEE REALLY GO AFTER PAWNSHOPS AND JEWELERS WHO HAD NO IDEA WHAT IS GOING ON?

They already are. Retail customers of Republic Metals have also been sued to claw-back funds received from the defunct refinery. If any of the precious metal refineries on this list are themselves driven into bankruptcy, it is foreseeable that their own customers may be sued in that later bankruptcy. Pease & Curren has never done business with Republic Metals, but pawnshops and jewelers who are using other refineries are advised to inquire whether their refiner ever did. If such a cascade of precious metal company bankruptcies were to occur, many retailers could be caught up in the fall out. It is important to remember that claw-back litigation does not necessarily require that the defendant being sued knew anything about the risks it was taking or did anything wrong. It is simply a way of spreading the inevitable losses that ensue when a defunct company can no longer meet its obligations among all involved parties.

HOW IS PEASE & CURREN DIFFERENT?

Pease & Curren has never done business with Republic Metals. We have the capacity to refine precious metals to pure (Check out our corporate video showing some of our processes). We have been in business for over one hundred years, and own our own precious metals refinery, the land it sits on, and all equipment. Aside from the recent Paycheck Protection Program giveaway, we are debt free and have been for many decades. When you work with Pease & Curren, peace of mind is one of the many benefits.

Call us at 800-343-0906 today to discuss the best refining plan for your business!

mvm

About the Author:

Before joining Pease & Curren, Frank Curren graduated from Georgetown Law and worked for a Boston based non-profit, focusing on litigation between debtors, creditors, and debt collectors.