The hair triggers are set. And this time, I’m not talking about guns. I’m talking about the gold hoarders. As a gold refiner, it is my privilege to talk to gold businesses every day. I’ve found that all over the country, people holding precious metals are waiting for “X” price before they sell. Lately, X is most often $2,000 per ounce.

Their logic is straightforward. The value of gold is seen as countercyclical: its price tends to rise when the business climate worsens and other assets, such as stocks, decline. The novel coronavirus is presenting one of the worst business climates anyone can remember, so to many it stands to reason that gold is going to go up and up.

“In the current environment, waiting for a certain price to unload large amounts of metals may not be the best strategy.”

The purpose of this post is to show why, in this gold refiner’s opinion, the situation is much more complex than that. In the current environment, waiting for a certain price to unload large amounts of metals may not be the best strategy. A gold hoarder looking for a specific gold price can resemble a thirsty desert traveler working his way to an oasis that is really a mirage: he does not realize that the destination is moving, and won’t be what he thinks it is when he gets there. And he is not seeing other dangers and opportunities lying off to either side.

Is this person searching for an oasis, hoarding gold, or going to the grocery store during COVID-19?

COVID-19 is as unique as it is devastating, and it should not be assumed that the markets will respond according to their usual playbook. The current markets are subject to a maelstrom of competing forces, such as the unprecedented government response to the virus, unpredictability as to the virus’ future course, and a patchwork of local shutdown orders with a twist of consumer fear. Understanding these forces will help anyone manage their precious metal stockpiles, regardless of what strategy they ultimately choose.

Gold heating up to its melting point at Pease & Curren. Is the gold market set to heat up or cool off?

cc

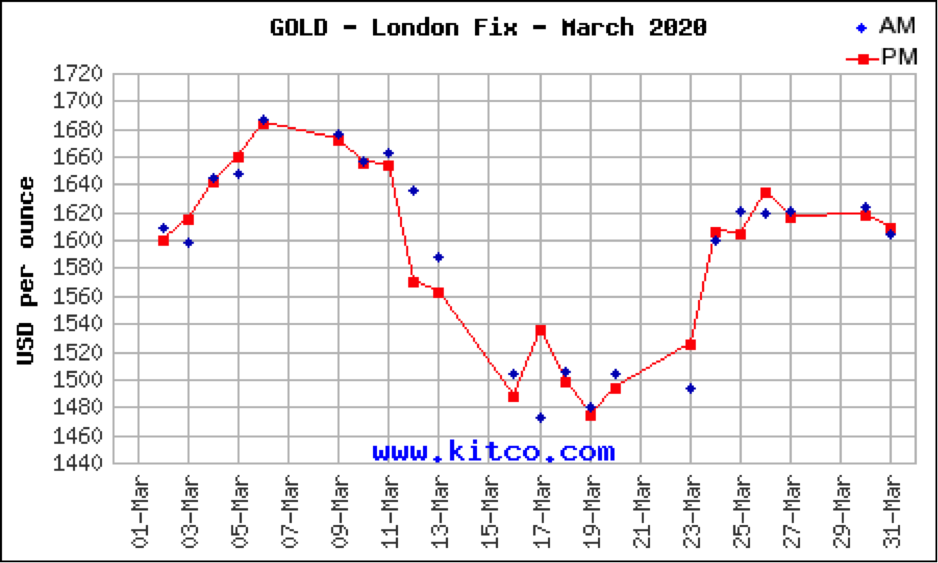

THE GOLD PRICE HAS STAYED STUBBORNLY FLAT DESPITE THE CLOSURE OF MANY GOLD REFINERS

Although Pease & Curren has remained fully operational throughout the COVID-19 crisis, many other gold refiners, such as the Royal Canadian Mint and various American and Swiss refiners have had shutdowns, severely constricting the available supply of pure gold. An interesting recent Bloomberg article, “The Wild Hunt for 100-Ounce Gold Bars,” told the fascinating story of how gold speculators owing gold deliveries as part of their trading activity had to scramble to meet these obligations in March, losing around a billion dollars in the process.

cc

Pease & Curren is open despite COVID-19.

Click here or call us at 800-343-0906

to order containers.

cc

Even with supply constrictions and intense demand from traders, the price of gold did not crack 1700 during March, and ended the month around where it started. This suggests that the gold price faces significant headwinds.

cc

GOVERNMENT RELIEF PROGRAMS WILL HAVE AN UNPREDICTABLE EFFECT ON THE ECONOMY

Keynsian economic theory calls for liberal governmental deficit spending during hard economic times to avoid depressions. Economist John Maynard Keynes famously stated when the business cycle trends downward, governments would be better off paying laid off workers to bury currency and dig it back up than to do nothing. The Federal government has delivered forcefully on this teaching, pumping trillions of dollars into the economy since the onset of COVID-19. The Paycheck Protection Program essentially offers to cover “small” (up to 500 employee) business’ payroll during next few months if they do not lay off their workers. For workers who are laid off, unemployment is “on steroids.” Due to lapses in the computing capabilities of unemployment offices, the government was unable to pay people 100% of their former incomes. Instead, they added $600/weekly to the standard benefits, in many cases causing workers to make more from unemployment than they do from their jobs. Due to incredibly low borrowing costs, the government has the ability to continue to bolster such relief efforts, although there may not be political interest in providing further aid.

Even John Maynard Keynes may not have been able to tell you which way the gold market is going during COVID-19!

If the government can use this relief to take care of businesses and individuals until a COVID-19 vaccine makes social distancing unnecessary, and if businesses can then reopen, the long-term economic effects of COVID will have been mitigated. Contrarily, if otherwise viable businesses shutdown permanently due to the virus, a long-term depression could take hold.

The twist is that in some cases the relief being offered by the government may be harming the economy. Going back to Keynes’ example of the workers being paid to bury and dig up currency, imagine if these workers left real jobs to take on this make-work. The economy would suffer from the resulting loss of productivity. Right now, the anomaly that many workers receive more for being unemployed than for working may also hurt the economy.

With so much difficulty predicting the business environment in the medium term, predicting that the price of gold will rise as the economy crumbles is no sure thing!

cc

INFLATION IS UNLIKELY TO RISE DESPITE THE LARGE GOVERNMENT DEFICIT

Gold prices often rise in response to inflation. When dollars are worth less, it takes more of them to buy gold. And when the value of the dollar is trending speedily downward, people wish to purchase gold to avoid this trajectory.

The Federal Government’s efforts to rescue the economy have been very expensive and led to the highest levels of deficit spending since World War II. Deficit spending can lead to inflation, as governments print more money to get out of debt. However, a recent article in the Wall Street Journal argues that inflation is likely to remain quite low because other economic forces are holding prices and wages down. In fact, as the article points out, inflation is currently likely to be lower than the Fed’s targeted rate of 2% per annum.

cc

OTHER COMMODITY PRICES AFFECT GOLD IN UNEXPECTED WAYS

The price of gold and other precious metals often move along with other, seemingly unrelated commodities. Capital tends to move according to trends. While someone might invest in a specific manufacturing company because she has a favorable impression of its product and management team, other institutions, funds, and individuals are buying that same stock and others because they simply want to invest in American manufacturing. Likewise, capital also tends to bid for commodities en masse. Largely for this reason, research shows that gold prices and oil prices move in the same direction 85 percent of the time.

cc

Discuss the Best Strategy for Your

Precious Metals Holdings at

800-343-0906 Today!

cc

“With the fate of so many commodities intertwined, a single-issue stance on the gold market may not lead to the most optimal investment strategy.”

The oil markets are largely fixed by sovereign nations that produce oil. This is the opposite of most industries where laws and regulations guard against price fixing. In March of this year, Russia and Saudi Arabia had a difference of opinion about how oil production levels should be set. The resulting price war caused a steep drop in the price of oil and the two petro-juggernauts sought to undercut each other. Although there is little real world connection between the two commodities, this diminishment in oil may have been a factor in gold’s stubborn refusal to go up in March, discussed above. With the fate of so many commodities intertwined, a single-issue stance on the gold market may not lead to the most optimal investment strategy.

cc

THE CONCEPT OF OPPORTUNITY COST ILLUSTRATES THE TRUE DANGER OF GOLD HOARDING

“I bought an asset for $5, and sold it for $10. That means I am a great investor, right?”

Not so fast. In the sense that the speaker doubled his money, one answer could be yes. But a more nuanced (and in the view of this gold refiner, better) analysis asks how much the speaker could have made by using that $5 in other ways. Now we are thinking in terms of opportunity cost. We have to know when the asset was purchased and when it was sold. Once we start asking these questions and thinking about opportunity cost, “I bought an asset in 1920 and sold it today for $10” does not look so hot.

cc

Do you purchase gold from members of the public?

Click here to join our Buyer Beware Newsletter.

cc

Everyone has different opportunities available to them and thus, different opportunity costs. Only a pawnbroker knows how much they could make by liquidating gold inventory with a gold refiner and making more loans. But one opportunity that is available to everyone is purchasing equities in the stock market.

Right now, the stock market has taken a steep decline from its pre-COVID-19 heights. If you had $5 ten years ago, even now, with an unexpected global pandemic, you would have been better off buying into the DOW Jones stock index than purchasing gold. Even with the enormous declines of this first quarter of this year, the DOW would have returned approximately 140 percent on your investment against 41 percent in gold (Click here to view the 10 year chart). And if you had the same $5 one hundred years ago, your returns on stock investments would have been approximately 33,000 percent higher than your returns on gold – even if you had to sell in today’s bear market. If it turns out he bought his $5 asset in 1920, the guy that made only 100 percent starts to look like the village idiot

cc

THIS WOULDN’T EVEN BE YOUR GRANDMOTHER’S $2,000/t.oz. OF GOLD!

Gold has never reached $2,000 per troy ounce. But what is $2,000 per troy ounce, anyway? Just as nothing is ever quite as good as the good old days, inflation means that gold at $2,000/t. oz tomorrow would not be as valuable in real terms as gold at $2,000/t. oz would have been in August 2011, when it exceeded $1911 per ounce in after-hours trading. In fact, gold would have to reach approximately $2,178/t. oz today to be as valuable as its $1,911 in high in 2011. Because the dollar is not a fixed benchmark, when you pick a selling price as a long-term strategy, you are dealing with a moving target, and your opinion of your own strategy can thereby be distorted.

We can guarantee that gold was not at $2,000 per pounce when grandma bought these rings.

cc

BEWARE OF LOOKING FOR BIG ROUND NUMBERS

Investing involves predicting the behaviors of many others. In this way is like commuting — to avoid traffic, you want to predict and avoid the routes that everyone else is taking. If you are waiting to unload your gold at $2,000/t. oz (or any other number), how many other people do you think are thinking the same thing? Perhaps more importantly, how many are sitting there thinking, “I’m going to wait for gold to go up to $2,000 to buy lots of gold”? Not many! But every seller needs a buyer, or the price goes back down. With many amateur investors selling at big milestones, asset prices often briefly poke above these big round numbers before quickly declining. This piece from the Wall Street Journal discusses the phenomenon with respect to stocks, but there is no reason not to apply it to commodity metals, like gold. Trying to sell gold at $2,000 may be like trying to get out of downtown Los Angeles at 5:30 rush hour.

cc

CHECK TO MAKE SURE YOU AREN’T AN ACCIDENTAL GOLD HOARDER

Not every gold hoarder knows they are a gold hoarder. Every gold business has the potential to become an accidental gold hoarder without a strategy in place. You may be buying gold from the public, you may be producing, selling or holding gold inventory, you may be using gold to make dental products, and you may be doing a mixture of all of these. Unless you use your gold refiner on a concerted, regular basis, you may accumulate sufficient inventory over time to be taking a big financial risk if precious metal pricing fluctuates. If the opportunity cost of gold hoarding and the complexity of the gold market have convinced you that hoarding gold is not the best strategy, call Pease & Curren at 800-343-0906 to discuss a schedule for shipping scrap that works best for your organization.

A collection of gold jewelry sent to Pease & Curren to be refined.

cc

I STILL WANT TO WAIT FOR A CERTAIN PRICE BEFORE SELLING MY PRECIOUS METALS. CAN MY GOLD REFINER HELP ME?

Yes. Whether you want to stay in gold and other precious metals, move out of them, or diversify, Pease & Curren is here to help. I started off talking about “hair-triggers” – holding for a certain price and then selling when it hits that price. Let’s say that even after reading this post, that remains your strategy. To do that, you need to move quickly when gold hits your target, and you can’t move quickly if your gold is in the form of broken jewelry or other scrap. Call us 800-343-0906 to discuss refining your materials now and holding them in our vault, or taking pure metals back to hold in yours. We have many options and we can work with you to find one that fits your strategy for your precious metals.

cc

About the Author

Before becoming a gold refiner, Frank Curren attended Georgetown Law and worked for a non-profit focusing on financial services litigation.

the piscivorous gold refiner

cc

cc

cc

cc

cc

cc

cc

cc